Investor Relations

- TOP>

- Investor Relations>

- Purpose・Long-Term Vision 2035・Medium-Term Management Plan 2030

Purpose・Long-Term Vision 2035・Medium-Term Management Plan 2030

Download the document

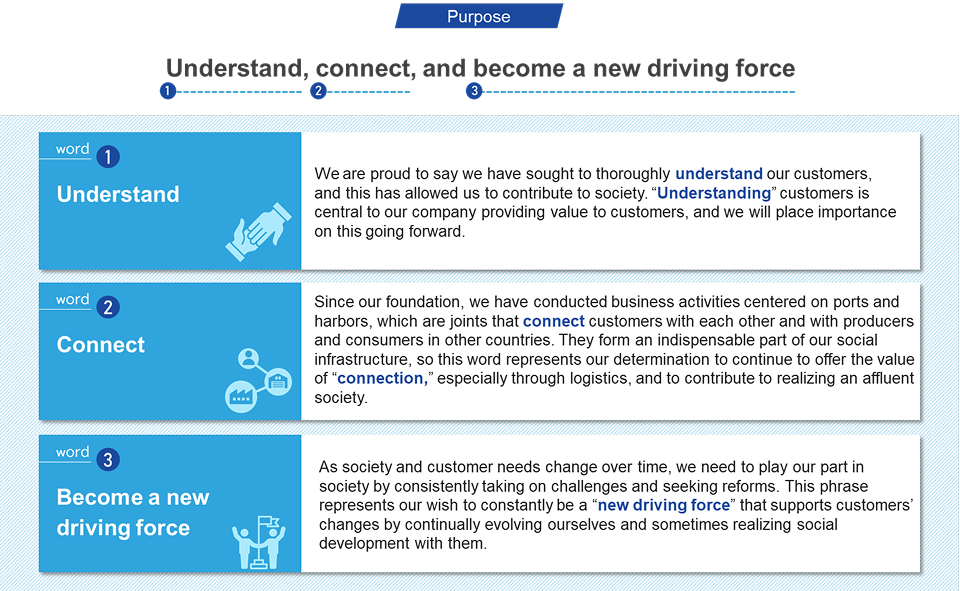

Purpose

Since our foundation in 1867, we have engaged in business activities centered on ports and harbors, which connect Japan and its people with the rest of the world. Through our business, we have supported logistics and contributed to the maintenance and development of society.

The Company has articulated the Company's Reason for Being (Company’s Purpose) as part of efforts to remain a company essential to society, even amid conditions of dramatic change and uncertainty. By clarifying its hallmark values and enhancing corporate value through the united efforts of its employees, the Company is seeking to contribute to a more prosperous society.

Three Words That Are Central to Our Purpose

Long-Term Vision 2035

(An ideal vision to be achieved over the long term)

Recognizing reforms based on a long-term perspective as central to sustaining business, the Company has established its Long-Term Vision 2035 based on the Company’s Purpose.

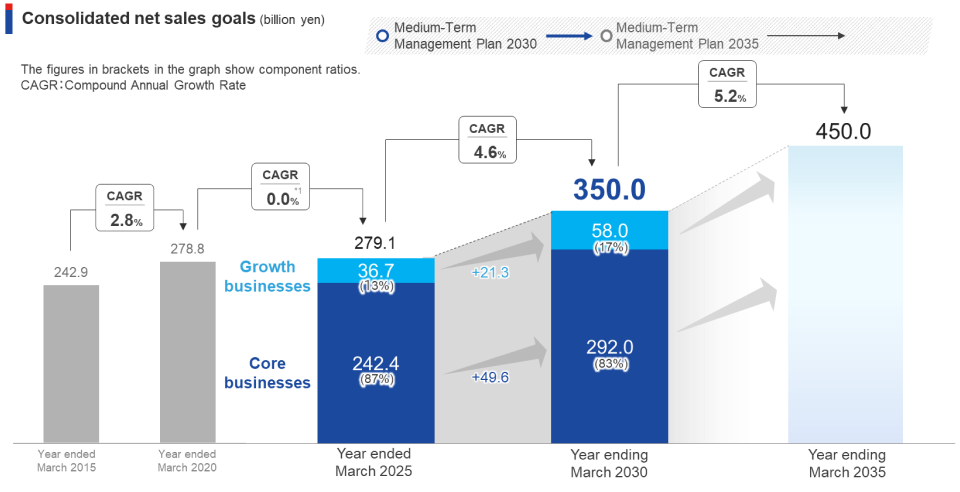

In striving to realize its ideal vision for 2035—Be an integrated logistics provider that designs the future of logistics in Japan and the world—the Company has set the financial target of ¥450,000 million in consolidated net sales.

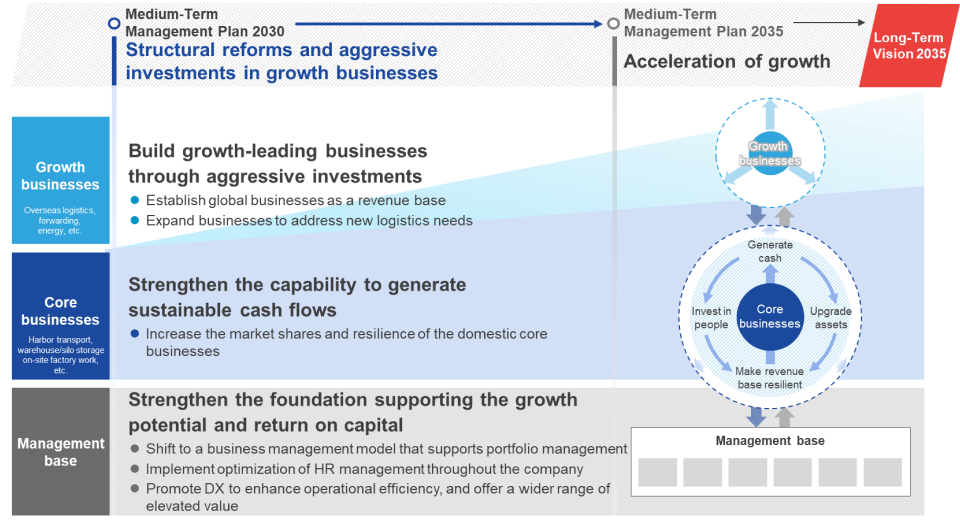

The Roadmap Toward Long-Term Vision 2035

Medium-Term Management Plan 2030 describes various measures for the first five years of the roadmap formulated by back casting from the goals of Long-Term Vision 2035. Under this plan, we will strive to improve our growth potential and returns on capital by investing aggressively in growth businesses, pursuing structural reforms that strengthen management foundations and our core businesses.

Growth in Net Sales

We will target consolidated net sales of 350 billion yen in the year ending March 2030, the final fiscal year of Medium-Term Management Plan 2030.

Moving toward the year ending March 2035, we will further strive to achieve 450 billion yen in consolidated net sales.

*1. Since the “Accounting Standard for Revenue Recognition,” (ASBJ Statement No. 29,March 31, 2020) had not yet been applied in the fiscal year ended March 2020, the figure cannot be directly compared with that for the fiscal year ended March 2025.

Medium-Term Management Plan 2030

Having set the goal of realizing Long-Term Vision 2035, the Company has established its new Medium-Term Management Plan 2030 for the five-year period through the fiscal year ending March 2030.

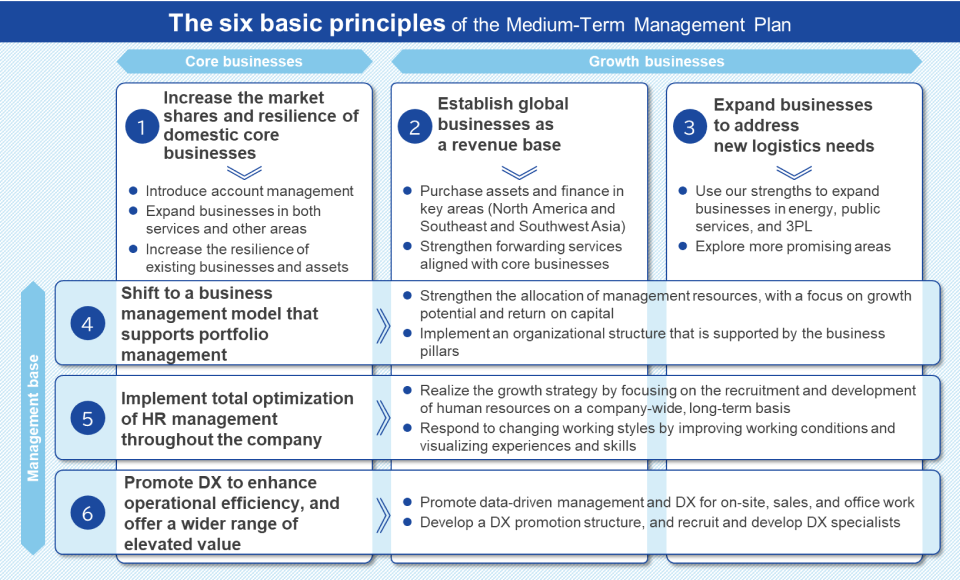

Based on the following six basic principles, this plan will enhance the Company's growth potential and returns on capital, drawing on the cash-generating capabilities of our core businesses to promote structural reforms and active investments in growth businesses.

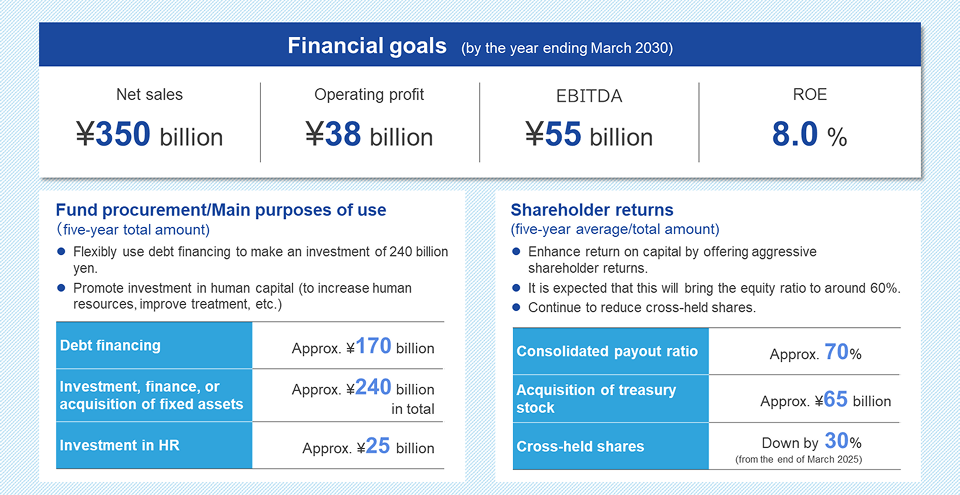

Numerical Goals to Be Achieved by the Year Ending March 2030

Make aggressive investments to increase net sales and enhance operating profit and ROE.

Improve return on capital by offering shareholder returns, and use debt aggressively.